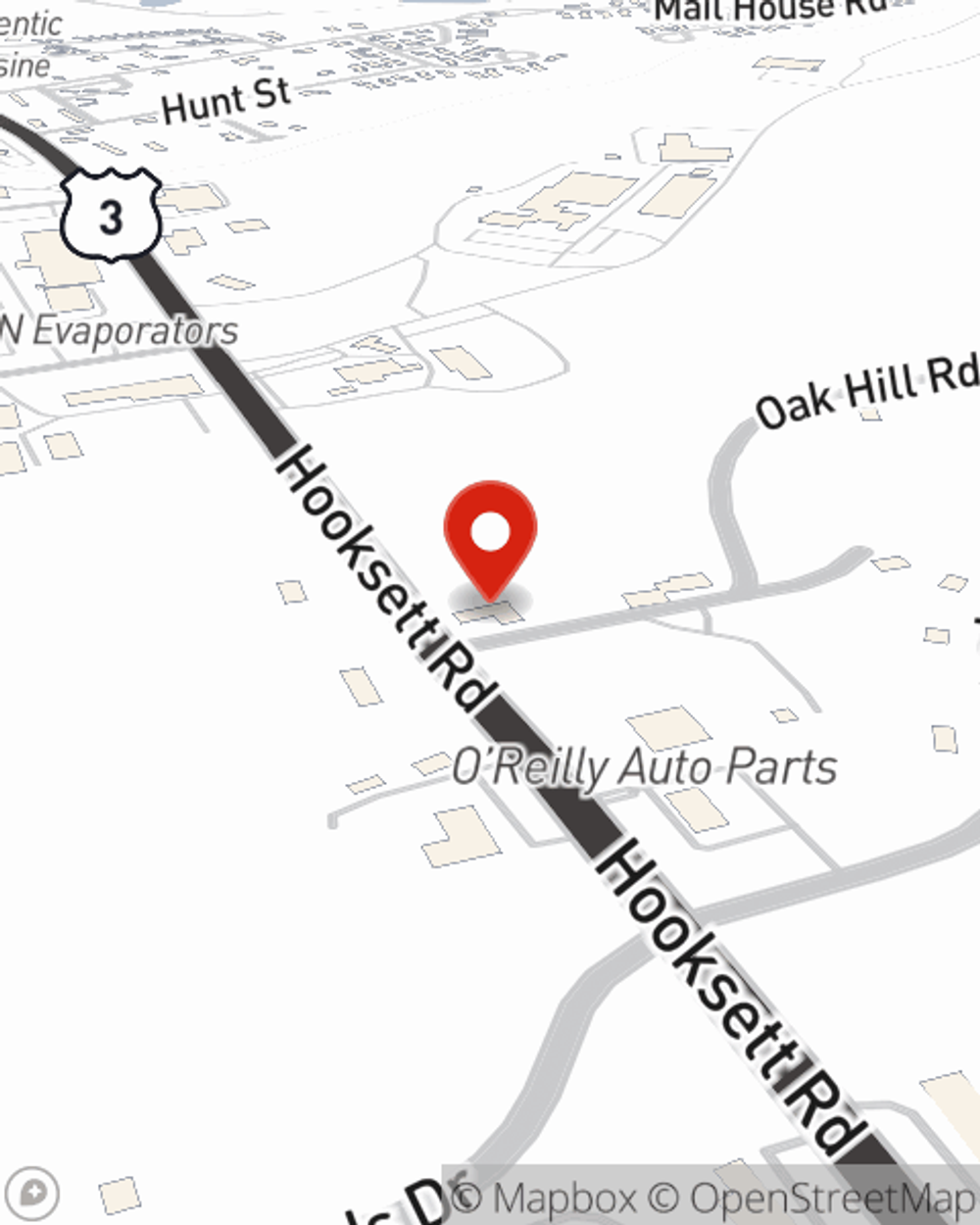

Life Insurance in and around Hooksett

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

When you're young and newly married, you may think you don't need Life insurance. But it's a perfect time to start talking about Life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Love Well With Life Insurance

Life can be just as unforeseeable when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers multiple coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific number of years, State Farm can help you choose the right policy for you.

No matter what place you're at in life, you're still a person who could need life insurance. Call or email State Farm agent Jamie Reynolds's office to learn more about the options that are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Jamie at (603) 232-7895 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Jamie Reynolds

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.